When you need help, start here

NetWorth24 Online Banking FAQs

Visit www.717cu.com/enroll and click the Sign Up button.

As a primary account owner, you will need the information below in addition to creating a username and password during enrollment.

• Date of Birth

• Mother’s maiden name

• Social Security Number (SSN)

• Account number

• Zip Code of the Primary Account

Joint owners creating their own access will use the information above.

Authorized signers and Trustees will enter their own social security number, date of birth, and Zip Code of the business or trust.

Once logged into Online Banking, to set up Bill Pay, click the Bill Pay tab and complete the short application. You will then have immediate access to begin paying bills.

Yes. Joint owners must create their own NetWorth24 login to access shares or loans they are joint or co-borrower on.

We encourage joint owners to create their own login to NetWorth24.

You will have FULL access to all Deposit, Investment and loan suffixes that you are joint owner or co-borrower on. You will be able to perform all of the following:

- Transfer To

- Transfer From

- Balance Inquiries

- Viewable History

- Viewable on Account Summary Page

Unfortunately, we had to restrict loan access – and remove the loans from the Account Summary page - due to lending regulations on open-ended loans because we can no longer give access to only loans on which you are a co-borrower. You will only have access to your cross account loans by going to the Transfers Tab and choosing to make a transfer to that loan.

You can log into Online Banking and Bill Pay using the log-in box on our home page.

If you do not remember your Username, click on “Forgot Password/Username?” in the log in box on our Home Page, choose “I forgot my Username” link and enter your email address connected to your NetWorth24 account and it will be emailed to you. If you do not remember your password, click on the same link in the log in box on our Home Page and follow the easy steps to have a new, temporary password sent to you.

Read the message provided on the screen when trying to log in. You may be able to reset your own log in credentials but there are times when the only solution is to call our Teleservices Dept. for assistance.

To protect transactions, we only accept log-ins originating from a browser that supports the highest level of encryption (128-bit). Encryption prevents transactions from being read by unauthorized parties over the Internet. Click here for browser requirements.

Security begins with your browser session. To protect transactions, we only accept log-ins originating from a browser that supports the highest level of encryption (128-bit). Encryption prevents transactions from being read by unauthorized parties over the Internet. Click here for browser requirements. We also offer Enhanced Multifactor Authentication which will recognize your computer using a cookie and allow you to reset your password by setting up your phone for receiving a text message, voice message or email so you can receive a one-time passcode.

- Change your Username and password immediately!

- Check your Security Options within NetWorth24 to ensure that your phone numbers and email address are correct.

- If you suspect fraud through NetWorth 24 during our regular business hours, take the above steps and contact us immediately to report it so that we can determine if we need to place a hold on your account.

- If this happens during non-business hours, take the above steps immediately (change your Username, password, etc.) and call the credit union at your earliest opportunity.

To provide optimal security, performance and reliability, NetWorth24 Online Banking requires that cookies be enabled on your Web browser. Cookies are a small piece of information that a Web server can store on your browser so the system recognizes your actions during a session.

As you browse the Web, some cookies are "set" on your Web browser. For example, cookies are used to store preferences you have requested on frequently visited Web sites. When you close your browser, some cookies are stored in your computer's memory in a cookie file, while some expire immediately. All cookies have expiration dates.

Cookies cannot be used to obtain data from your computer, get your email address or access sensitive or personal information. The only way that any private information could be part of your cookie file would be if you personally provided that information to a Web site. Also, each cookie can only be read at the site where it was created.

Pop-up functionality is used by many Web sites to display advertisements to users, but some services like this one, use pop-up functionality to draw attention to important information. Since this service uses pop-ups as an alert mechanism, it is recommended that you permit pop-ups for this Web site. For example, if you attempt to set-up a recurring payment for a biller that already has a payment set up, you may be prompted with a pop-up message to ensure you are not setting up a duplicate payment by mistake.

Clicking “Help” in NetWorth24 Online Banking will provide you information about your current page. Frequently Asked Questions are available by clicking “Help” within NetWorth24 Bill Pay. If you have additional questions, you can always get assistance simply by clicking on the Support link at the top right side of the screen. The Secure Support area will allow you to send and receive secure emails.

NetWorth24 can display a year of history but only images of checks written in the past 90 days will display.

Yes. You can transfer funds to your loan as a principal only payment or as a regular payment.

A confirmation page is presented at the conclusion of any transfer on the system. You are given the opportunity to print a “Printer Friendly” version of this page at that time. You are also given a confirmation number for any bill payment set up using NetWorth24 Bill Pay and it will be displayed in your Bill History.

If your online session is inactive for a 10 minutes (that is, if you have not submitted any transactions, clicked on any new pages, or have been strictly inside of NetWorth24 Bill Pay for 10 minutes), you will receive a pop-up message warning that you will be logged off if there is no further activity. Clicking "Yes" upon receiving the message will allow you to proceed with your online banking session. The online service is designed this way to provide you with maximum security in case you forget to log out.

Activity inside of the Bill Pay tab or the Money Management tab does not constitute activity inside of NetWorth24 Online Banking. Therefore, you will still receive a pop-up message about NetWorth24 inactivity. Click “OK” to continue your session.

Yes. Once your account has been disbursed, you will see it on your Account Summary page.

Yes. NetWorth24 Online Banking allows you to export your account information into a formatted file (QFX, CSV formats available). The file will be downloaded onto your hard drive where it will be available for you to import into a personal financial management software program such as Quicken or Microsoft Money.

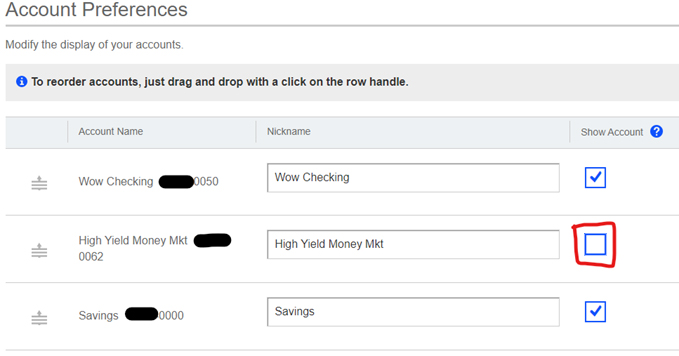

Tips for members who want to hide accounts in online banking

Primary members using online banking see all their own accounts plus all the accounts in which they are joint-owners. If you would like to hide accounts you don’t want to see, please follow these steps:

- Login to NetWorth24 Online Banking from a computer

- Click on My Settings in the upper right corner of online banking

- Scroll to the bottom of that page and select Rename & Hide your accounts

- To hide an account from view, uncheck the box under the column Show Account

To set up Bill Pay, you must first sign up for NetWorth24 Online Banking. Once that is done, simply click on the Bill Pay tab inside of NetWorth24 and complete the short application. You will then have immediate access to begin paying bills.

You can pay virtually anyone in the United States -- from national bank cards, mortgage companies, auto loans, and department stores to the paper boy. Payees not eligible for payment through this service include governmental agencies such as the Internal Revenue Service, all state and local tax authorities, collection agencies and recipients of court-ordered payments like child support or alimony. Organizations or individuals outside of the United States are also excluded. Payments to government agencies for utilities such as water are permitted.

We issue two kinds of payments: electronic and check. Electronic payments are delivered the next business day and check payments are delivered within 4 business days. A convenient calendar widget can be used when scheduling payments to see the earliest date that the payment can actually be delivered.

Electronic payments: If our Bill Pay trusted partner has an electronic relationship with your payee, your payment will be made electronically and your account will be debited on the due date you selected.

Check payments: If our Bill Pay trusted partner does not have an electronic relationship with your payee, your payment could be made by check in one of two ways: Corporate checks (most common) - where the check acts just like it had been written out of your checkbook and the funds are debited from your account when the payee receives and negotiates the check. Laser drafts - where your account is debited on the due date you selected and one large check for multiple members is sent to your payee.

An eBill is an electronic copy of your bill, which you can view anytime within the Bill Pay service. eBills are a secure, convenient way to keep all of your bills in one place. We’ll let you know when each eBill arrives, and we’ll help you keep track of when they’re due.

We make the past 24 months of your payment history and eBills available for you to view online. If you need payment information from more than 24 months back, give us a call. We'll help to retrieve that information.

On the Bill Pay tab, your scheduled payments are listed on the right. Pending Payments can be changed or deleted. If you no longer see the options to "Change or Delete" a payment on this screen, it cannot be deleted. Stop payment orders can only be placed in certain circumstances and must be made in person, by phone or by email. A stop payment fee may apply. See our Service Charge Schedule.

Recurring transfers and payments can be scheduled until you choose to stop them. After the recurring transfer or payment is scheduled, you will always have the option to edit or delete the transaction.

Payments processed through NetWorth24 Bill Pay will be covered by Overdraft Protection or Courtesy Pay if you have opted in to these services for ACH (electronic payments) or Check (check payments). Fees may apply. If you have not chosen to use either of these services – or if you have exhausted these services, your payment may not be made and/or you may incur NSF fees. See our Service Charge Schedule.

Payments scheduled on a Saturday, Sunday or holiday will be processed on the previous business day.

CheckFree, our trusted Bill Pay partner, will bear the responsibility for any late-payment-related charges (up to $50) should a payment arrive after its due date as long as you scheduled the transaction in accordance with the service's terms and conditions.

If a payment is scheduled in accordance with our Payment Guarantee guidelines, your fees may be covered up to $50. You will need to provide documentation of any fees assessed in order to receive a credit.

7 17 Credit Union provides banking services throughout Austintown, Boardman, Canfield, Canton, Cortland, Howland, Hubbard, Kent, Ravenna, Vienna, Warren, and Youngstown, OH. Bank with us today!